2010s: Technology, e-business and cyber risk continue to shape the industry's future

In today's discussion about digital start-up companies disrupting the insurance industry, it is often forgotten that the sector embraced technological innovations very early on, especially in the life business. For example, back in the 1930s, punched card systems were introduced to make the administration process more efficient. In 1969, a US life insurance company launched CompuServe, the first important online service. Already by the 1980s, insurers increasingly used computers to develop risk models. At Swiss Re, catastrophe and loss data from the sigma database was used to create scenarios.

Insurers face pressure to adapt and reinvent themselves

In the middle of the dotcom boom in 2000, sigma explored the impact of the internet on the insurance sector. As Amazon generated more than USD 2.5 billion in revenues from online sales, the financial sector lagged behind. According to a 2000 edition of sigma that covered the impact of e-business on the insurance industry, the marketing of products via the internet presented a number of difficulties, including differences in the regulatory and supervisory frameworks across countries. Even at that time, clients expressed concerns about data security.

The insurance sector faced particular difficulties that hindered its ability to sell products via online distribution channels. Many products were complex, and claims settlement required significant investigation and decision-making. Despite such reservations, sigma correctly predicted that sales of online insurance would grow, especially in standardised personal lines such as motor. Other lines were also expected to profit due to the "enormous potential for improvements in quality and service levels" as well as "better tailored products, shorter response times, greater flexibility in cover structures, and better risk management support".

Making life insurance more attractive

In 2013, a sigma on life insurance that focused on consumers revisited the old adage that life insurance is sold rather than bought. Behavioural economics theories were applied to explain the lack of interest in buying life insurance. The study concluded that psychological and behavioural biases created reluctance and that markets could fail due to asymmetric information and adverse selection. In that sigma, the authors also noted that the internet offered new opportunities as it empowered consumers to compare prices and products online to secure best value, carefully weigh options, review content and share their opinions. The internet also provided yet another channel to market life insurance.

In 2015, a sigma study on life insurance in the digital age explained how other digital innovations were set to change life business:

A wide range of technological changes will affect the future of the insurance industry. These developments include data and analytics, artificial intelligence and cognitive computing, new medical technologies, wearable devices and digital health, and the Internet of Things

According to the study, the wide availability of electronic health records (EHR) was expected to transform underwriting in life insurance. EHR often contained various types of traditional data, including medical history, family history or prospective medical treatment, but also new real-time data sources, such as wearable medical devices. Central availability of this information could help to streamline and speed up the process of underwriting a life policy. In addition, EHR could make life insurance more attractive and cheaper. Even high-risk customers could access affordable products by granting insurers access to their health data. Nevertheless, the study highlighted two main challenges: regulators were likely to limit insurers' use of this kind of data for underwriting and questions remained about data security.

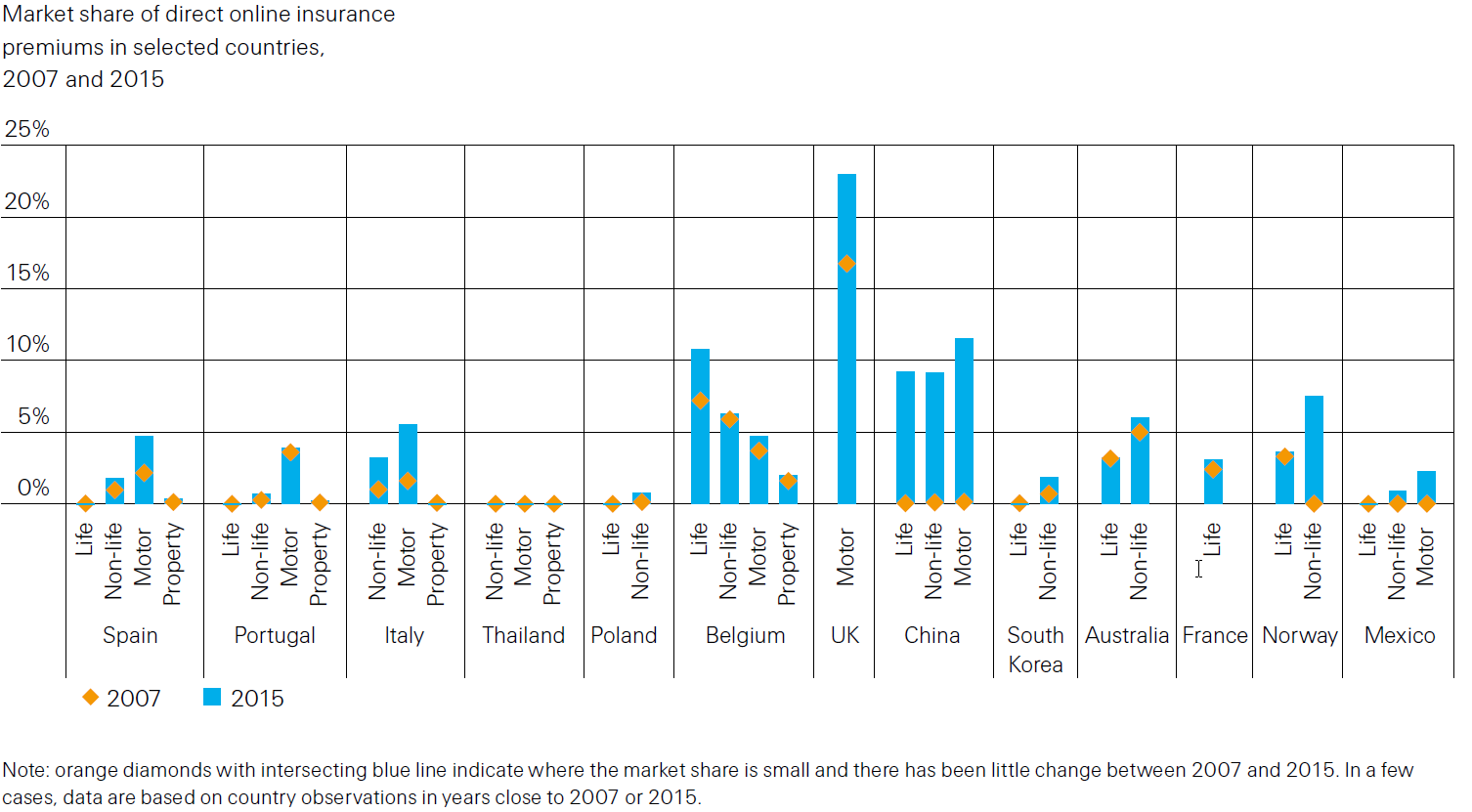

A quiet revolution of the non-life insurance distribution process

Among advanced insurance markets, the increase in online distribution on the non-life side was gradual and varied by country and line of business. Insurers were beginning to experience how the use of the internet influenced customer buying behaviour. In the UK motor insurance market, e-commerce had even come to dominate other distribution channels. At the same time, the increasing use of real-time vehicle tracking and the ability to monitor driving behaviour (telematics) also facilitated innovation in motor insurance. New products and services emerged, such as personalised cover (usage-based insurance) and supplementary services, such as assistance in case of an accident and warnings of dangerous roads or high theft areas.

Big data and InsurTech

Digital interaction with clients facilitates the gathering of useful data. This results in large data pools where data analytics can be applied to extract business intelligence. Such Big Data usage, noted in a 2014 sigma on digital distribution in insurance, could transform the insurance industry as it would allow insurers to "assess their customers' needs, target products and services to individuals and businesses, and support underwriting decisions".

New market entrants, also referred to as InsurTech, the sigma noted, posed new challenges for traditional players in the insurance industry. Also, social media offered the potential for customers to group together and negotiate discounts. Such peer-to-peer initiatives often resulted in the foundation of new companies as digital advances significantly reduced start-up costs.

Also in the insurance industry, boundaries became increasingly blurred when non-insurance participants such as big tech companies entered the market. However, success was not guaranteed. Google's auto insurance comparison portal "Compare" closed down soon after its launch in 2015. Other InsurTechs miscalculated the cost of online platforms, while some ran into difficulties with regulators or failed to recruit talent with the required insurance expertise.

Mobile insurance distribution and micro-insurance

Digital progress also helps insurance in emerging markets become affordable and accessible. Mobile technology is key to increasing insurance penetration in emerging markets as many potential customers there have mobile phones but are not part of the formal financial system. In addition to identification programmes, the rapid spread of hand held devices and mobile money platforms made premium collection less costly and easier. On the other hand, mobile communication technology also supported claims verification and payment. Furthermore, it presents an opportunity to collect data and enable remote underwriting. Yet, as reported in a 2015 expertise publication, traditional insurers face new competition:

Insurers face a big risk of losing relevance in this market. The leading technology service providers have essentially taken over insurance functions such as product design, underwriting, policy administration and claims, and use local insurers mainly for licensing and capital requirements.

Cyber risks create unforeseen challenges

Awareness of cyber risks has existed since the early 1970s. Malware at that time was more of a pastime for academics having fun with each other. The first crime to draw international attention happened in 1986 when German hacker Markus Hess invaded US military computers and sold the data to the Russians. In 2000, the "I Love You" virus was one of the first computer worms to make international headlines and affect a wide range of users who opened the malicious attachment.

In 2013, sigma 4/2013 warned that:

The transport sector could be especially vulnerable to cyber risk – the potential failure, malfunction, or misuses of information technology infrastructure. […] Cyber-attacks are commonly excluded from "All-risk" marine and aviation policies. But with corporate awareness of the threat increasing, demand for cyber risk extensions to existing policies, as well as dedicated cover against related business interruption losses and liability claims, has risen.

In January 2017, Swiss Re Institute published a sigma devoted to cyber risks. The "corporate awareness" sigma had referred to a few years earlier had grown, yet companies had been neglecting security measures, despite professing an increased awareness of the risks. Ransomware was also identified as a rapidly growing threat. Four months after the cyber sigma was published, one of the worst ransomware attacks, WannaCry, confirmed sigma's concerns. Losses from the WannaCry attack have been estimated as high as USD 8 billion. Soon after the event, speculation about future attacks increased. Yet, quantifying cyber risks remained a challenge. According to sigma:

An inductive approach to modelling risk is straightforward for many perils, [but] the nature of cyber risks presents a new set of challenges. The frequency and severity of cyber events is not easy to establish, making it difficult to assess potential aggregate losses.

One problem was the lack of historical data, sigma explained. The main problem, however, was that cyber risks are "constantly evolving with new actors, attack methods and technologies coming into play, making it extremely difficult for firms to understand and monitor their exposure".

Boosting cyber resilience and the continuing digitalisation of insurance

Extending insurability of cyber risk and non-tangible risk more broadly will be a key challenge and growth opportunity for insurers in the years to come. There are encouraging signs, however, as insurers are beginning to understand cyber risks better and underwrite the risk. Also governments have a role to play by encouraging information capture and dissemination about cyber threats. Readers of earlier chapters in this series will remember that other risks such as natural catastrophes were deemed virtually impossible to insure at some point but, eventually, were mastered and modelled. When dealing with cyber risks, the same could happen again. Meanwhile, the journey to offer insurance on online channels as only just begun. Insurance companies still have ample room to "turn up the volume" sigma 3/2017.

"The digitalisation of insurance distribution is set to continue, but the pace of change will vary across markets. Digital channels will ultimately be used throughout the distribution process, from information gathering to purchase completion to aftersales service. But not all insurance transactions will migrate online, and intermediaries will continue to play an important role."