1980s: risk management and the liability crisis

One would assume that sophisticated risk management has long been a raison d'etre of re/insurers. Surprisingly, however, it is too not far back that risk assessment practices in re/insurance were anything but rigorous. In 1981, for example, in the third edition of sigma of that year ("Professionalism in Reinsurance "), when asked what statistics he used to assess risks, a London underwriter reportedly said: "I have 20 years of experience…I don't need any statistics".

Historically, actuaries concentrated mostly on calculating life risks, where statistics were more readily available. Non-life risks were widely seen as too erratic. Non-life reinsurance business is "beyond the bounds of underwriting on a formula basis", the renowned publication The Review stated in December 1955. Over time, however, new actuarial theories produced what Swiss Re actuary and board member Hans Bühlmann later termed the "actuary of the second kind": the non-life actuary.

The origins of risk management

The tenth edition of sigma from 1981 "Risk management and insurance", was dedicated entirely to risk management, explaining that the discipline originated in the US. After the second world war, Martin Trippel from Swiss Re's Risk Management Service Centre wrote, "the US insurance market developed from a sellers' into a buyers' market, and the insurance managers of large enterprises and security officers started to examine the possibilities of cutting the amount spent on premiums without reducing the scope of cover". What this meant is that firms began to upgrade their own risk management processes, such that they could handle more risks in house and spend less on insurance cover.

Risk management was thus born out of cost-benefit calculations. The term itself started being popularised in an insurance manual called Risk Management in the Business Enterprise written by American authors Robert Mehr and Bob Hedges in 1963. Subsequent publications developed the concept in different directions. Some saw risk management as a new term for loss prevention and loss reduction. Others envisaged it as theory that should guide all decision on top levels, according to sigma No 10/1981.

New risks for insurers to manage

For enterprises and insurers, one fundamental remains always true: the risk landscape is ever changing, and sometimes with devastating consequences. In the early 1980s, a new disease was making headlines: AIDS, which posed many dilemmas for life insurers, not to mention society at large. A 1988 sigma study "AIDS: The status of the epidemic and the possible economic consequences" said the population most affected by AIDS were 20-40 year olds, a group that had previously claimed the least benefits. The sigma said that in the US, group life pay-outs due to AIDS-related deaths were 2.5 higher than other death causes. In the individual life segment, the difference was even greater suggesting that anti-selection "must have taken place to a considerable extent". New life contracts could exclude the risk, but the big unknown was how many life policies written in the past might be impacted.

Non-life insurers were also facing new uncertainties, at a time when there was little loss history to assess the exposures posed by then common-day big risks such as oil tankers, nuclear power plants and large airliners. The evolving risk landscape of the 1980s presented many challenges for insurers. sigma studies investigated the impact of oil crises, increasing coverage of social insurance, and changing regulatory frameworks and rising inflation. In sigma No 3/1986, a "gloomy outlook of worldwide politics, growing social tension, difficulties in adjusting economic policies among the western industrial countries, problems of demographic development [and an] unfavourable economic development" was noted.

A global insurance crisis

Liability issues were by not new for insurers, but in the 1980s they were about to drive the US insurance industry to the brink of collapse. The cost of liability cover in the US increased dramatically across all sectors. It was not just doctors facing expensive litigation claims for medical malpractice who found it increasingly difficult to get cover. Liability insurance costs for teachers, fire brigades, police officers and many other professions skyrocketed also. In March 1986, Time Magazine's front page read: "Sorry, America. Your Insurance Has Been Canceled".

sigma No 12/1986 identified the problems in the "troubling aspects of the US tort system". The jury-system allowed lay-people to determine liability even in complex cases and award punitive as well as "pain and suffering" damages. Furthermore, the contingency fees of around 30% for lawyers provided incentives that caused the practice to get out of hand. And, as so many foreign insurers had flocked to the US, the crisis reverberated throughout the world.

Where have all the insurers gone?

Throughout this period, insurer insolvencies were commonplace because of the spiralling claims cost they faced. In 1986, special Enclosures to sigma were introduced to keep clients updated on the developments. These detailed extraordinary cases such as the California school district that reportedly settled out of court for six figures with a teenage burglar rendered quadriplegic by falling through a rooftop skylight. Or the USD 1 750 000 (more than USD 4 million at 2017 prices) awarded to a 32-year-old doctor who suffered a heart attack "while repeatedly yanking the starter cord of an obstinate lawn mower". Notwithstanding their oddity, such cases were not infrequent.

The largest losses, though, came in what was dubbed "APH": Asbestos, Pollution and Health. Asbestos risks, especially, had been underwritten unwittingly decades ago. The soaring claims costs left their mark in the profit and loss accounts of insurance companies. The Enclosure to sigma No 4 in 1986 stated that overall pre-tax losses of the US P&C industry had gone up from USD 3.8 billion in 1984 to USD 5.5 billion in 1985 (5% of net premiums written) on account of soaring liability claims. Actuaries coined the term "superimposed inflation" to demonstrate how awards developed out of proportion with normal inflation. At the same time, however, they struggled to find ways of applying this in the design of new insurance policies.

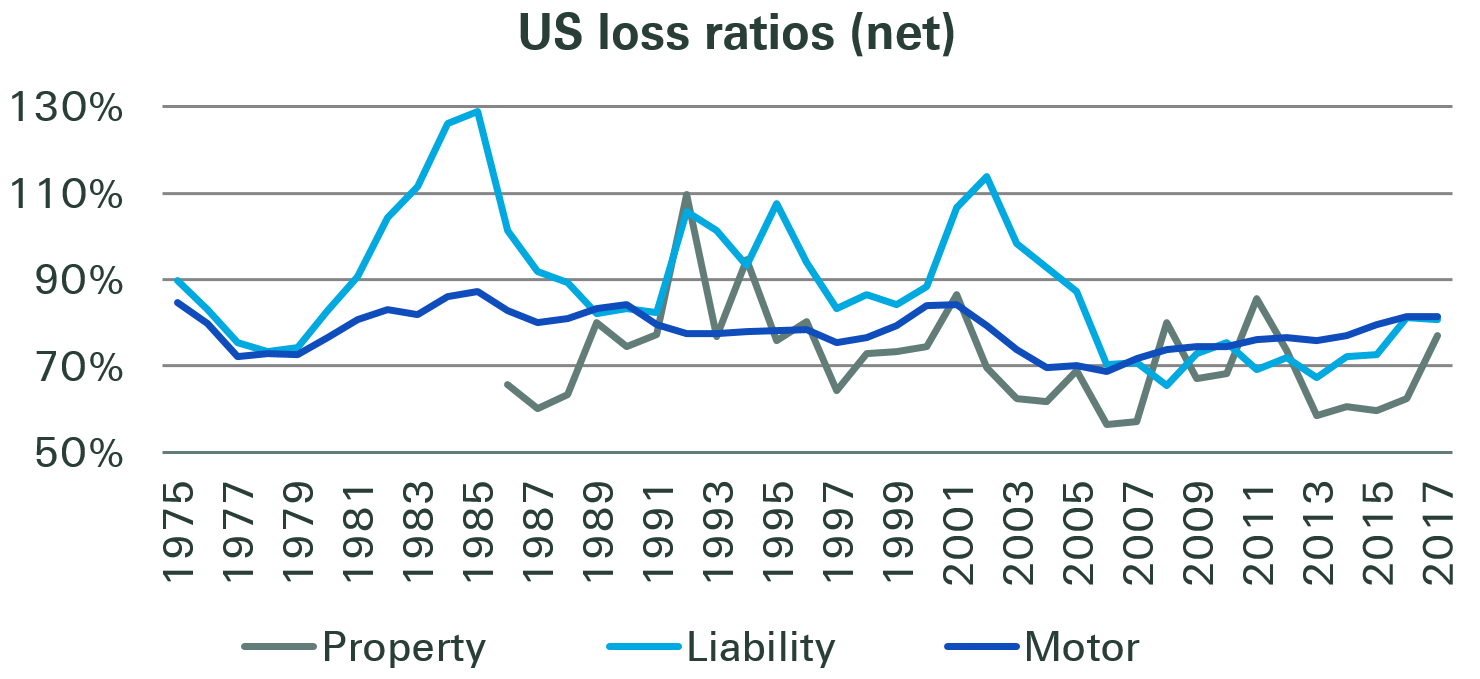

Development of loss ratios in key US non-life branches

Source: Swiss Re Institute

Economic theory and changes in social values

In 1988, the sixth edition of sigma "Liability insurance in the wake of changes in social values" looked back at the crisis and noted some lessons learned. Experience had shown "that society's values regarding the sharing of the burdens of risk had changed greatly", the sigma said. The resulting claims burden from the liability crisis were to continue to weigh on the insurance sector for decades. The sector will always remain susceptible to changing societal norms and circumstances not known or fully understood at the time of contract conclusion: in other words, the ever-changing risk landscape. The lessons learned during the 1980s improved risk management and will help the insurance industry deal with the challenges of tomorrow. However, with the dawn of a new generation of risk variables -- cyber risk, machine learning or self-driving cars to name a few immediate examples – it remains prudent for re/insurers, regulators and lawmakers alike (and together) to expect and be prepared for new liability loss "surprises" along the way. With ready access to adequate capital resources, the re/insurance sector can continue to fulfil its utility to society.