1990s: globalisation and liberalisation

Article information and share options

Globalisation, deregulation and liberalisation of the world insurance markets became a dominant theme for sigma during the 1990s. The fall of the Berlin Wall in 1989 marked the end of the cold war, and heralded the beginnings of a new world order. In commerce, the momentum of change was further supported with the foundation of the World Trade Organisation (WTO) in 1994 and subsequent treaties on trade liberalisation, which made markets more accessible and opened up entirely new markets to international competition.

The slow opening of Europe's insurance markets

At the start of the 1990s, the rules for what was to become a single market for insurance services in today's Europe Union (EU) were still being defined. The treaty of 1957 establishing the European Economic Community had already envisaged free movement of capital, freedom of establishment and freedom of services. Only during the 1970s, though, was freedom of establishment introduced, first for non-life and in 1979 for life insurers. But this had only limited impact on cross-border activities as local regulation continued to complicate matters.

Stage two, the introduction of freedom of services, was delayed until the late 1980s. Once introduced, insurers were in principle able to sell their products across borders without having to set up shop in host locations. But again, local regulations were a stumbling block. While multinationals did enjoy privileges of home country control over business such as industrial or transport insurance, national regulators were reluctant to give up control over personal lines. sigma illustrated this with an example of a German household buying personal effects insurance in the Netherlands, where the rates and conditions had to be approved in Germany. The freedom of services was theoretical and, in effect, most markets remained closed.

A regulatory revolution in Europe

In 1992, a third generation of directives brought a radical shift for the European insurance market, based on three key elements: "the single EU licence, the principle of Home Country Control, and the abolition of substantive insurance supervision". The last, sigma observed, implied far reaching freedom of pricing across the single market area and "from a historical perspective, […] could be described as a regulatory revolution".

By facilitating cross-border insurance services, the aim was to increase competition and lower insurance rates for EU consumers.[1] It was expected that the EU country with the best and most competitive system would ultimately set the standard for the member states, and better position EU insurers to take on global business. This did not happen without costs for smaller insurers: there had been mergers in the 1980s and the wave intensified in the 1990s.

Eastern European promise

While all this was happening, neighbouring countries in Eastern European were undergoing a long and arduous transformations from command to market-based economies. sigma dedicated several issues to the transition of East European insurance markets. The first was in 1990, which estimated average spend per capita on insurance in Eastern Europe to be around USD 100 per year, well below the western European average of USD 820. Overall, Eastern Europe accounted for just 0.8% of world insurance premiums, and western European insurers were quick to establish presence in the region to tap into the latent growth potential.

"A hard road from insurance monopoly to market", sigma says

However, when sigma revisited the numbers for Eastern Europe in 1994, premium volumes had fallen. In south-east Europe, they were less than half where they had been in 1988. One reason was a collapse in agricultural insurance, a no-longer mandatory line in the no-longer command regimes. In explaining the slowdown in insurance markets, sigma also pointed to weak economic environments and difficult transitions, exemplified by high inflation, breakdowns in production, falling income levels and rising unemployment.

In 1998, sigma published a fifth study on Eastern Europe. Even then, the latent growth potential had yet to materialise, but there were signs of structural change as former state monopolies increasingly lost ground to the private sector. And, with the gradual spread of compulsory motor insurance, it was hoped that growth would kick in soon. In life insurance, the reform of pension schemes was expected to accelerate sales. Some high-performing markets were emerging, with demand for insurance in Poland growing faster than in most of its east-bloc peers.

New momentum for globalisation

Globally, deregulation of trade in services came about from 1995 when the WTO's General Agreement on Trade and Services (GATS) came into force. Among other, GATS opened up trade in banking and insurance products and, critically, offered international insurers better access to two key regions: Latin America and Asia. In 1992, sigma speculated if these two markets were to be "the most dynamic insurance markets of the nineties?"

As it turned out, the East Asian economies – the Asian tigers – outperformed Latin America. sigma identified several reasons for the economic success stories such as growing exports of raw materials from Asia, increasing foreign direct investments (FDI) into the region, and much improved political and social stability. In contrast, the growth rates of 10% in Latin America seen in the 1970s had come to an abrupt halt in the 1980s amidst a series of economic crises, inefficient management of state investments, soaring interest rates and declining FDI. This weakened demand for exports, a development further exacerbated by high inflation and the tendency of Latin American countries to overvalue their currencies. The expansion of the Latin American insurance markets, particularly on the life side, only picked up speed once inflation retreated in the mid-1990s. Nevertheless in 1997, sigma concluded that "on the whole, the insurance industry in the countries of Latin America is still relatively insignificant". Aggregate premium in Latin American accounted for just 1.5% of global volumes.

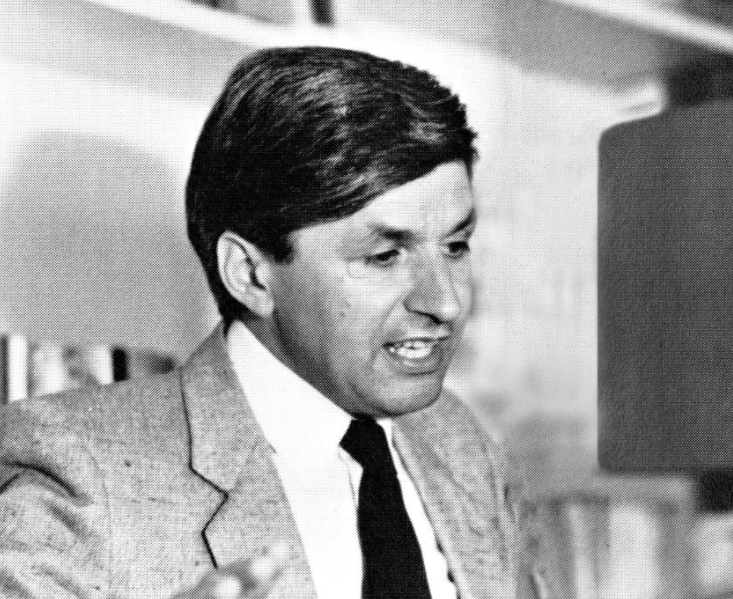

Peter Marbacher, head Economic Research, 1986-1994

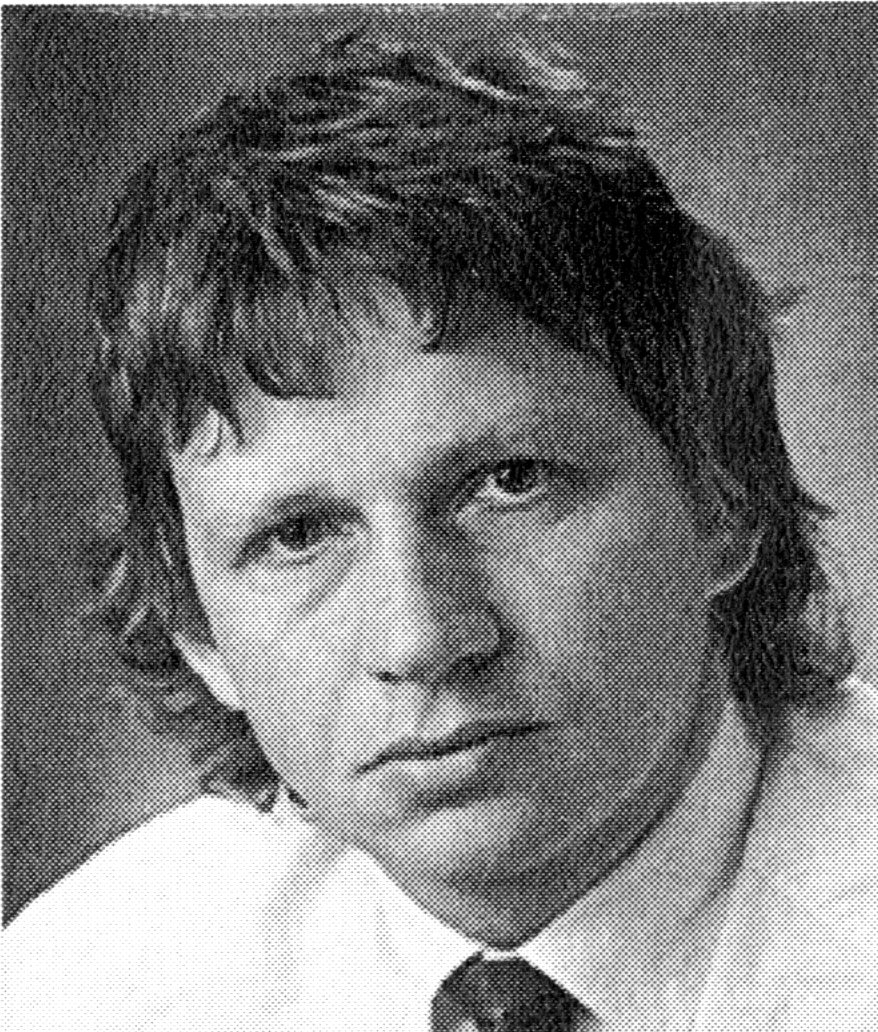

Thomas Hess, head Economic Research & Consulting 1994 to 2011

Thomas Hess took over as head of Swiss Re's Economic Research from Peter Marbacher in 1994. He opened new bureaux for his department in New York and Hong Kong, meaning that sigma had its finger on the pulse when one of the most dramatic changes in Asian insurance history happened. The strong growth of other more advanced markets in Asia, such as Korea and Taiwan, stimulated demand for both in life and non-life insurance covers, especially savings products. But then came 1997, and the Asian financial crisis. Following massive depreciation of the Thai baht, "most countries in the region were dragged into an unprecedented financial and economic crisis", sigma reported in 1999 in an edition called "Asia's insurance markets after the storm". The report stated that insurers had suffered massive losses in premium income, but also on their balance sheets.

Asia to rise again?

While some countries recovered fairly soon, Japan suffered "a prolonged economic slump" and also had the most saturated market in Asia. The Japanese market experienced some of the most pronounced changes in its long history. According to sigma in 1999, it was "a sea change" of market consolidation, new competitive parameters, and the convergence of financial intermediaries.

Insurance penetration in Japan (premiums/GDP)

Remark: Structural break of life insurance data in 1978

Source: Swiss Re Institute

Other countries instituted new rules also. With implementation of the GATS agreement, by 1999 over 100 countries opened up to trade in services. For sigma, the implication was clear: "Asian insurance markets are set to re-emerge as some of the world's fastest growing".

References

- The EU was formally established in November 1993 with the signing of the Maastricht Treaty.